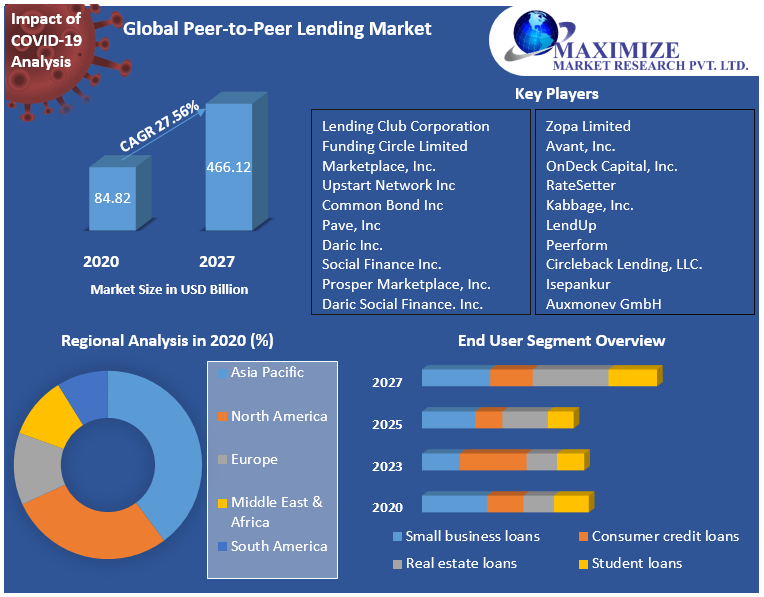

Global peer-to-peer lending market size was US$ 84.82 Bn in 2020 and is expected to reach US$ 466.12 Bn by 2027, at a CAGR of 27.56% during forecast period.  To know about the Research Methodology :- Request Free Sample Report Peer-to-peer or P2P lending is a process of lending money to individuals or businesses through online services that connects lenders with borrowers. There is no middleman (Financial institution) between lender and borrower. The report has covered the market trends from 2016 to forecast the market through 2027. 2020 is considered a base year. Special attention is given to 2020 and effect of lockdown on the demand and supply, and also the impact of lockdown for next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

To know about the Research Methodology :- Request Free Sample Report Peer-to-peer or P2P lending is a process of lending money to individuals or businesses through online services that connects lenders with borrowers. There is no middleman (Financial institution) between lender and borrower. The report has covered the market trends from 2016 to forecast the market through 2027. 2020 is considered a base year. Special attention is given to 2020 and effect of lockdown on the demand and supply, and also the impact of lockdown for next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

COVID-19 impact on market

COVID-19 has the potential to have three major effects on the global economy: directly impacting production and demand, causing supply chain and market disruption, and having a financial impact on businesses and financial markets. Our analysts, who are monitoring the situation throughout the world, believe that the market would provide producers with lucrative opportunities following the COVID-19 dilemma.

Global peer-to-peer Lending Market Dynamics

The global peer-to-peer lending market research report provides a comprehensive analysis of growth drivers, restrain factor, challenges and future opportunities of the market. An increase in the adoption of online application and demand of technology traditional banking systems are driving the growth of market. P2P lending offers some benefits such as higher return to the investors, more accessible source of funding and lower interest rates are expected to drive the growth of market. Furthermore, P2P lending offers more flexibility than other types of lending platform. Nevertheless, peer-to-peer lending comes with a few downsides such as credit risks, no insurance, no government protection and strict legal laws and regulations of the government, which could hamper the growth of market. Interest is no tax free is the major restrain factor that could hamper the growth of market.

Global Peer-to-Peer Lending Market Segment Analysis

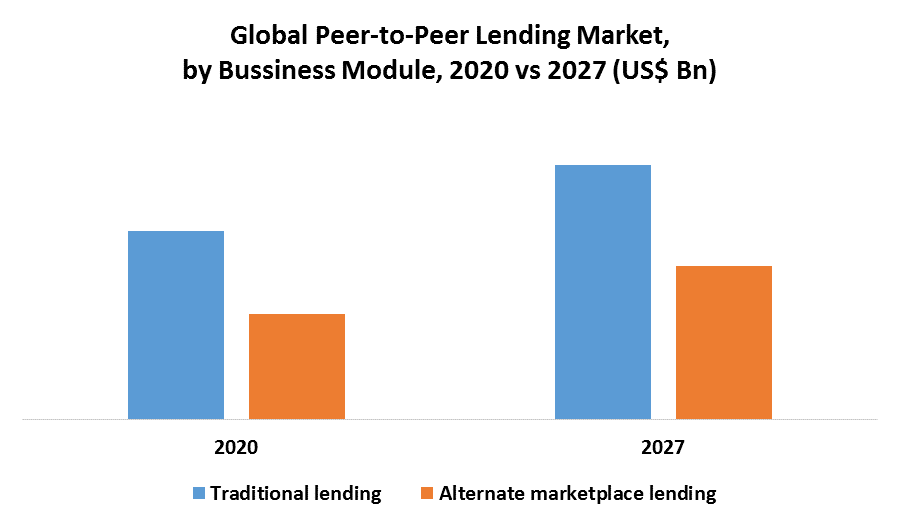

By business model, traditional lending segment dominated the market in 2020. It is the most common type of lending loan to the small and medium size enterprises. In traditional P2P lending, the platform manages the debt collection, transactions and marketing concerning both lenders and borrowers. The process is simple and easy to understand, which is driving the growth of market. Moreover, traditional lending offers some benefits such as higher quality of loans, high transparency, simple and straightforward lending and always direct investment structure are improving the growth of P2P lending market. Additionally, alternate marketplace lending segment is expected to witness the growth during forecast period.  By end user, small business loans segment dominated the market in past few years and is expected to maintain its dominance at CAGR of XX% during forecast period. To start up the new business, small business loan is required to invest in infrastructure, upgrade to the latest plant, expand operations and machinery, maintain inventory, or to increase working capital, which is ultimately driving the growth of market.

By end user, small business loans segment dominated the market in past few years and is expected to maintain its dominance at CAGR of XX% during forecast period. To start up the new business, small business loan is required to invest in infrastructure, upgrade to the latest plant, expand operations and machinery, maintain inventory, or to increase working capital, which is ultimately driving the growth of market.

Global Peer-to-Peer Lending Market Regional Analysis

Region wise, Asia Pacific has dominated the P2P lending market and is expected to grow market at CAGR of XX% during forecast period. Developing economies such as China, India and Japan have dominated the market in past few years. This is owing to the increasing small and medium size business in the region.  Furthermore, in China many micro loan companies have emerged to serve the 40 million SMEs and the growing internet users and e-commerce institutions of P2P lenders are founded with various target customers and business models. In addition, peer-to-peer lending platforms in India are helping a huge section of borrowers for a loan from banks, which improving the growth of the peer to peer lending in the region. The objective of the report is to present a comprehensive analysis of the Global Peer-to-Peer Lending Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding global market dynamics, structure by analyzing the market segments and project the global market. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the global market make the report investor’s guide.

Furthermore, in China many micro loan companies have emerged to serve the 40 million SMEs and the growing internet users and e-commerce institutions of P2P lenders are founded with various target customers and business models. In addition, peer-to-peer lending platforms in India are helping a huge section of borrowers for a loan from banks, which improving the growth of the peer to peer lending in the region. The objective of the report is to present a comprehensive analysis of the Global Peer-to-Peer Lending Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding global market dynamics, structure by analyzing the market segments and project the global market. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the global market make the report investor’s guide.

Global Peer-to-Peer Lending Market Scope: Inquire before buying

Global Peer-to-Peer Lending Market, by Business Model

• Alternate marketplace lending • Traditional lending

Global Peer-to-Peer Lending Market, by End User

• Small business loans • Consumer credit loans • Real estate loans • Student loans

Global Peer-to-Peer Lending Market, by Region

• North America • Europe • Asia Pacific • South America • Middle East and Africa

Global Peer-to-Peer Lending Market Key Players

• Lending Club Corporation • Funding Circle Limited • Marketplace, Inc. • Upstart Network Inc • Common Bond Inc • Pave, Inc • Daric Inc. • Social Finance Inc. • Prosper Marketplace, Inc. • Daric Social Finance, Inc. • Zopa Limited • Avant, Inc. • onDeck Capital, Inc. • RateSetter • Kabbage, Inc. • LendUp • Peerform • Circleback Lending, LLC. • Isepankur • Auxmoney GmbH • Lendingtree Inc. • On Deck Capital Inc. • Retail Money Market Ltd. • Social Finance Inc. • Zopa Limited Frequently Asked Questions: 1. Which region has the largest share in Global Peer-to-Peer Lending Market? Ans: Asia Pacific region holds the highest share in 2020. 2. What is the growth rate of Global Peer-to-Peer Lending Market? Ans: The global market is growing at a CAGR of 27.56% during forecasting period 2021-2027. 3. What segments are covered in Global Peer-to-Peer Lending market? Ans: Peer-to-Peer Lending Market is segmented into business model, end user and region. 4. Who are the key players in Global Peer-to-Peer Lending market? Ans: The important key players in the Peer-to-Peer Lending Market are – Lending Club Corporation, Funding Circle Limited, Marketplace, Inc., Upstart Network Inc, Common Bond Inc, Pave, Inc, Daric Inc., Social Finance Inc., Prosper Marketplace, Inc., Daric, Social Finance, Inc., Zopa Limited, Avant, Inc., onDeck Capital, Inc., RateSetter, Kabbage, Inc., LendUp, Peerform, Circleback Lending, LLC. 5. What is the study period of this market? Ans: The Global Peer-to-Peer Lending Market is studied from 2020 to 2027.